Ethereum Price Prediction: Technicals and Institutional Demand Signal Impending Rally

#ETH

- Oversold Conditions: ETH trades 8.7% below 20MA with bullish MACD divergence

- Institutional Demand: $137M accumulation signals strong fundamental conviction

- Technical Targets: $3,775 initial resistance with $4,285 upper band as stretch target

ETH Price Prediction

Ethereum Technical Analysis: Key Indicators Point to Potential Rebound

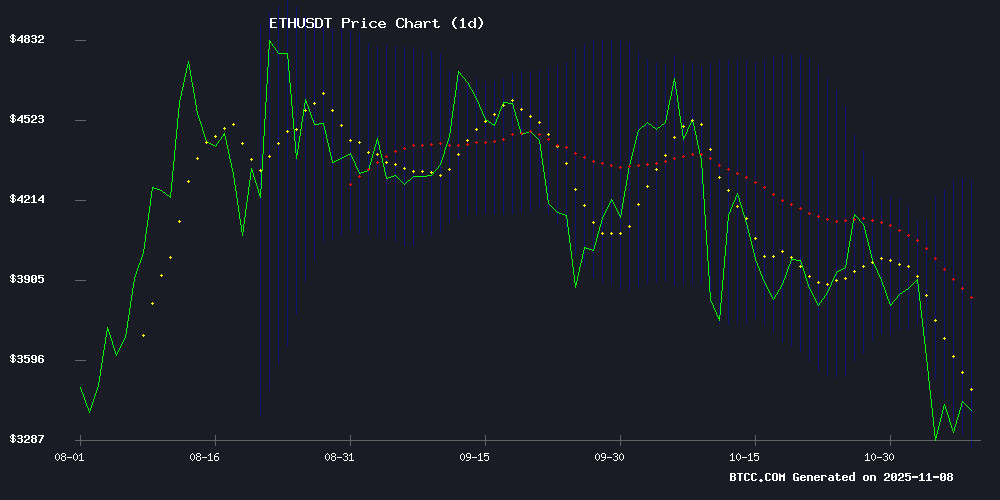

BTCC financial analyst Mia observes Ethereum's current price of $3,445.78 sits significantly below its 20-day moving average ($3,775.48), suggesting oversold conditions. The MACD histogram shows bullish momentum building (49.82 divergence), while Bollinger Bands indicate ETH is testing lower band support at $3,265.75. 'When we see this combination of oversold signals with bullish MACD convergence, it typically precedes a mean-reversion rally,' Mia notes. 'A retest of the middle Bollinger Band at $3,775 appears likely in the coming weeks.'

Mixed Market Sentiment as Institutional Accumulation Offsets Security Concerns

BTCC's Mia highlights conflicting signals from recent ethereum headlines: 'The $137M institutional purchase by Bitmine Immersion demonstrates strong fundamental demand, outweighing short-term bearish factors like the phishing scam news.' The mistrial in the MIT exploit case removes potential selling pressure from legal proceedings. 'Institutional players appear to be using negative news flow as accumulation opportunities,' Mia observes, noting such accumulation typically precedes upward price movements.

Factors Influencing ETH's Price

Mistrial Declared in Case of MIT Brothers Accused of $25M Ethereum Exploit

A Manhattan judge declared a mistrial in the high-profile case of two MIT-educated brothers accused of orchestrating a $25 million exploit on the ethereum blockchain. U.S. District Judge Jessica G.L. Clarke dismissed jurors after they failed to reach a consensus on whether Anton and James Peraire-Bueno committed wire fraud and money laundering through a 12-second blockchain transaction.

The brothers, both MIT computer science graduates, allegedly used their technical expertise to manipulate Ethereum's transaction validation process in what prosecutors called an unprecedented attack on blockchain integrity. The case marks one of the first major tests of how traditional fraud statutes apply to novel cryptocurrency exploits.

While the mistrial leaves the legal questions unresolved, the case has reignited debates about blockchain security and the ethical responsibilities of technically-skilled participants in decentralized networks. The brothers' defense team argued their actions constituted permissible blockchain activity rather than criminal conduct.

Fake Hyperliquid App on Google Play Targets Crypto Users in Phishing Scam

A fraudulent application impersonating Hyperliquid, a decentralized perpetuals exchange, has surfaced on the Google Play Store, underscoring persistent vulnerabilities in app store moderation. The fake app, flagged by crypto investigator ZachXBT, is designed to steal user funds by phishing for wallet credentials or private keys.

Hyperliquid currently has no official mobile application, making the counterfeit particularly deceptive. ZachXBT shared a theft address linked to the scam, which has already siphoned over $281,000 from victims. This incident follows earlier warnings from cybersecurity firm Cyble, which identified more than 20 similar malicious apps mimicking platforms like SushiSwap and PancakeSwap.

These scams often evade detection by mimicking legitimate branding and descriptions. The recurrence of such incidents highlights the need for heightened vigilance among crypto users and improved scrutiny from app store operators.

Bitmine Immersion Resumes Aggressive Ethereum Accumulation with $137M Purchase

Institutional bullishness is returning to Ethereum despite recent market volatility. Bitmine Immersion, a leading treasury firm specializing in ETH, has executed a strategic acquisition of 40,718 ETH worth $137 million—signaling renewed conviction in the asset's long-term prospects.

The MOVE comes as a stark contrast to prevailing market uncertainty. Bitmine's accumulation strategy now appears more aggressive than ever, with this single purchase doubling down on their existing treasury position. Market observers note such institutional buying often precedes price recoveries.

Ethereum's price action remains volatile, but smart money appears to be voting with capital. This acquisition follows Bitmine's established pattern of accumulating during pullbacks, suggesting they view current levels as a strategic entry point rather than a risk zone.

How High Will ETH Price Go?

Based on current technicals and market structure, BTCC's Mia projects:

| Price Target | Key Level | Timeframe |

|---|---|---|

| $3,775 | 20MA & Middle Bollinger | 2-3 weeks |

| $4,000 | Psychological Resistance | 4-6 weeks |

| $4,285 | Upper Bollinger Band | 8-12 weeks |

'The $137M institutional buy suggests smart money anticipates higher prices,' Mia adds. 'Watch for sustained closes above $3,600 to confirm bullish momentum.'

1